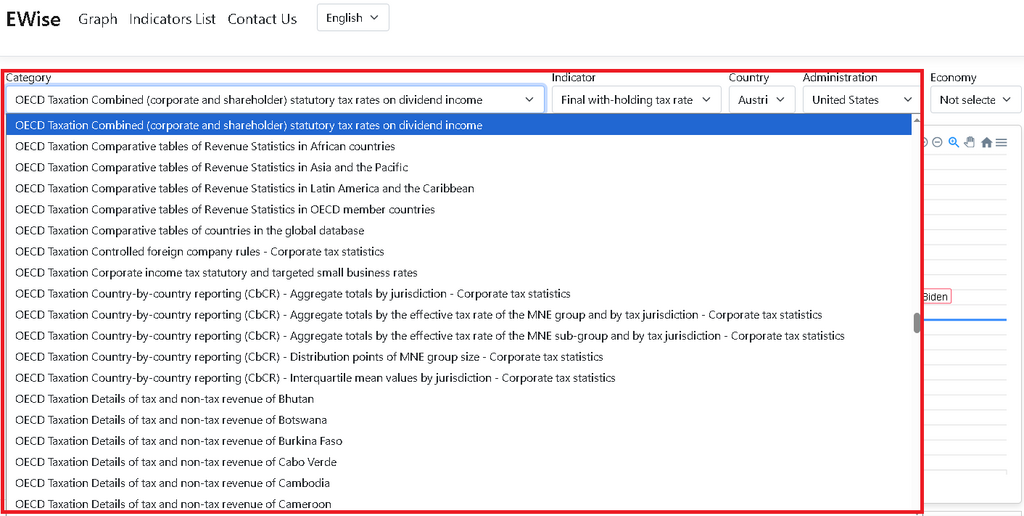

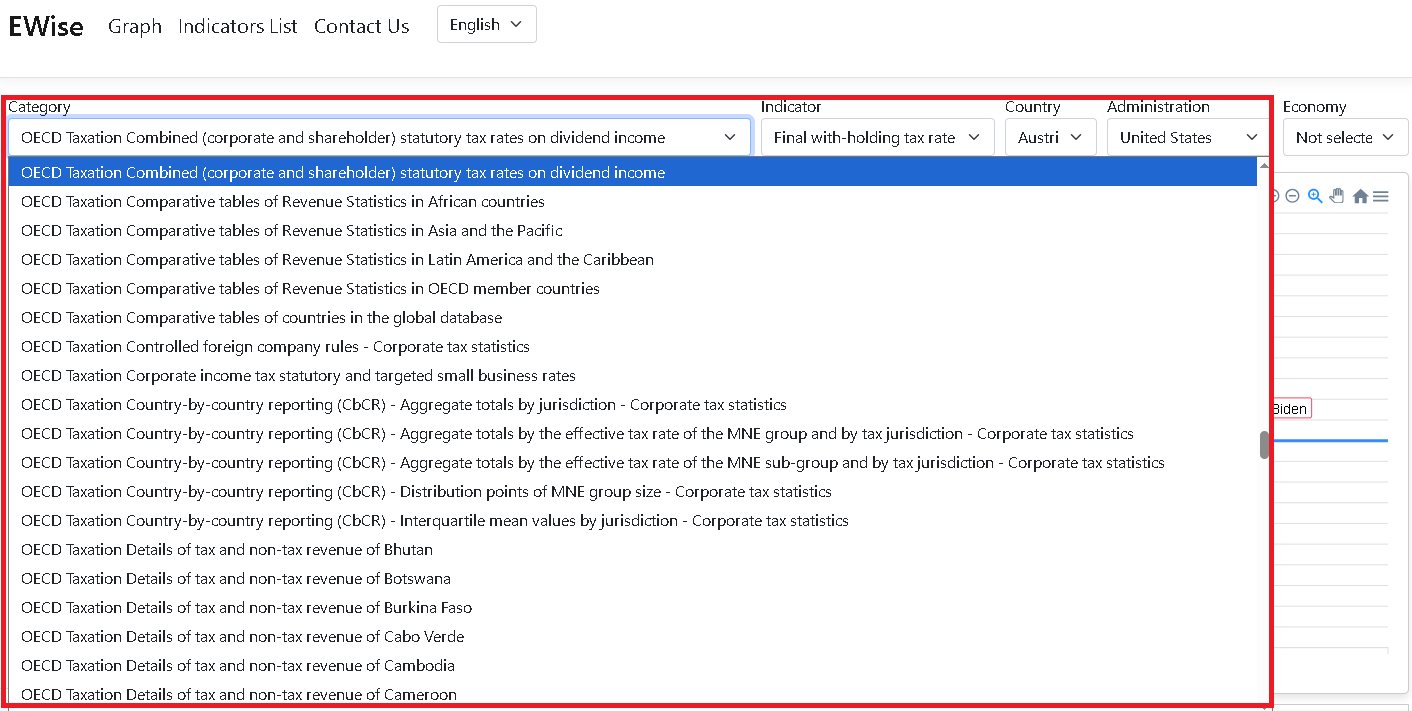

We have added various indicators of OECD tax data for each country to EWise – Unikktle.com.

You can graph the OECD tax data for each country and the government data to check the changes over time.

https://unikktle.com/

Newly added indicators

| OECD Taxation Carbon pricing score | Carbon pricing score |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Combined personal and corporate income tax rates |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Corporate income tax as a share of total tax paid |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Corporate income tax rate on distributed profit |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Distributed profit rate |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Final with-holding tax rate |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Grossed up dividend |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Imputation or dividend tax credit |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Imputation rate |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Net personal tax |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Personal income tax as a share of total tax paid |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Personal income tax rate on grossed-up dividend |

| OECD Taxation Combined (corporate and shareholder) statutory tax rates on dividend income | Pre-tax distributed profit rate |

| OECD Taxation Comparative tables of Revenue Statistics in African countries | Non-tax revenue |

| OECD Taxation Comparative tables of Revenue Statistics in African countries | Tax and non-tax revenue |

| OECD Taxation Comparative tables of Revenue Statistics in African countries | Tax revenue |

| OECD Taxation Comparative tables of Revenue Statistics in Asia and the Pacific | Non-tax revenue |

| OECD Taxation Comparative tables of Revenue Statistics in Asia and the Pacific | Tax and non-tax revenue |

| OECD Taxation Comparative tables of Revenue Statistics in Asia and the Pacific | Tax revenue |

| OECD Taxation Comparative tables of Revenue Statistics in Latin America and the Caribbean | Tax revenue |

| OECD Taxation Comparative tables of Revenue Statistics in OECD member countries | Tax revenue |

| OECD Taxation Comparative tables of countries in the global database | Tax revenue |

| OECD Taxation Controlled foreign company rules – Corporate tax statistics | Controlled foreign company rule |

| OECD Taxation Controlled foreign company rules – Corporate tax statistics | Is there a controlled foreign company rule in place? |

| OECD Taxation Controlled foreign company rules – Corporate tax statistics | Significant controlled foreign company exemption and exclusion requirements |

| OECD Taxation Controlled foreign company rules – Corporate tax statistics | Substantial activity requirements |

| OECD Taxation Controlled foreign company rules – Corporate tax statistics | Year of introduction of the controlled foreign company rule |

| OECD Taxation Corporate income tax statutory and targeted small business rates | Combined corporate income tax rate |

| OECD Taxation Corporate income tax statutory and targeted small business rates | Corporate income tax rate |

| OECD Taxation Corporate income tax statutory and targeted small business rates | Corporate income tax rate exclusive of surtax |

| OECD Taxation Corporate income tax statutory and targeted small business rates | Corporate income tax rate less deductions for sub-national taxes |

| OECD Taxation Corporate income tax statutory and targeted small business rates | Sub-central government corporate income tax rate |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Accumulated earnings |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Adjusted profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Administrative, management or support services business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Dormant business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Employees |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Entities |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Holding or managing intellectual property business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Holding shares or other equity instruments business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Income tax accrued – current year |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Income tax accrued ? current year relative to profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Income tax paid (on cash basis) |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Insurance business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Internal group finance business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Manufacturing or production business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Multinational enterprise groups |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Multinational enterprise sub-groups |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Other business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Provision of services to unrelated parties business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Purchasing or procurement business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Regulated financial services business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Related party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Research and development business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Sales, marketing or distribution business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Stated capital |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Tangible assets other than cash and cash equivalents |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Total revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by jurisdiction – Corporate tax statistics | Unrelated party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Accumulated earnings |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Adjusted profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Administrative, management or support services business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Dormant business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Employees |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Entities |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Holding or managing intellectual property business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Holding shares or other equity instruments business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Income tax accrued – current year |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Income tax paid (on cash basis) |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Insurance business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Internal group finance business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Manufacturing or production business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Multinational enterprise groups |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Multinational enterprise sub-groups |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Other business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Provision of services to unrelated parties business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Purchasing or procurement business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Regulated financial services business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Related party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Research and development business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Sales, marketing or distribution business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Stated capital |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Tangible assets other than cash and cash equivalents |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Total revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE group and by tax jurisdiction – Corporate tax statistics | Unrelated party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Accumulated earnings |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Adjusted profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Administrative, management or support services business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Dormant business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Employees |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Entities |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Holding or managing intellectual property business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Holding shares or other equity instruments business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Income tax accrued – current year |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Income tax paid (on cash basis) |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Insurance business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Internal group finance business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Manufacturing or production business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Multinational enterprise groups |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Multinational enterprise sub-groups |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Other business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Provision of services to unrelated parties business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Purchasing or procurement business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Regulated financial services business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Related party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Research and development business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Sales, marketing or distribution business activity |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Stated capital |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Tangible assets other than cash and cash equivalents |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Total revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Aggregate totals by the effective tax rate of the MNE sub-group and by tax jurisdiction – Corporate tax statistics | Unrelated party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Distribution points of MNE group size – Corporate tax statistics | Employees |

| OECD Taxation Country-by-country reporting (CbCR) – Distribution points of MNE group size – Corporate tax statistics | Tangible assets other than cash and cash equivalents |

| OECD Taxation Country-by-country reporting (CbCR) – Distribution points of MNE group size – Corporate tax statistics | Unrelated party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Accumulated earnings |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Employees |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Entities |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Income tax accrued – current year |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Income tax paid (on cash basis) |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Multinational enterprise groups |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Multinational enterprise sub-groups |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Profit (loss) before income tax |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Related party revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Stated capital |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Tangible assets other than cash and cash equivalents |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Total revenues |

| OECD Taxation Country-by-country reporting (CbCR) – Interquartile mean values by jurisdiction – Corporate tax statistics | Unrelated party revenues |

| OECD Taxation Details of tax and non-tax revenue of Bhutan | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Bhutan | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Bhutan | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Botswana | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Botswana | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Botswana | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Burkina Faso | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cabo Verde | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cabo Verde | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cabo Verde | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cambodia | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cambodia | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cambodia | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cameroon | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cameroon | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cameroon | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Chad | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Chad | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Chad | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cook Islands | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cook Islands | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Cook Islands | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Côte d’Ivoire | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Côte d’Ivoire | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Côte d’Ivoire | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Egypt | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Egypt | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Egypt | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Equatorial Guinea | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Equatorial Guinea | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Equatorial Guinea | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Eswatini | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Eswatini | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Eswatini | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Fiji | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Fiji | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Fiji | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Gabon | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Gabon | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Gabon | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Ghana | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Ghana | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Ghana | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Guinea | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Guinea | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Guinea | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Hong Kong, China | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Hong Kong, China | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Hong Kong, China | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kazakhstan | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kazakhstan | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kazakhstan | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kenya | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kenya | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kenya | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kyrgyzstan | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kyrgyzstan | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Kyrgyzstan | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Lao PDR | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Lao PDR | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Lao PDR | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Lesotho | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Lesotho | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Lesotho | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Madagascar | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Madagascar | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Madagascar | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Malawi | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Malawi | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Malawi | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Maldives | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Maldives | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Maldives | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mali | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mali | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mali | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Marshall Islands | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Marshall Islands | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Marshall Islands | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mauritania | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mauritania | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mauritania | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mauritius | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mauritius | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mauritius | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mongolia | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mongolia | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mongolia | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Morocco | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Morocco | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Morocco | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mozambique | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mozambique | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Mozambique | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Namibia | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Namibia | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Namibia | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Nauru | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Nauru | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Nauru | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Nigeria | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Nigeria | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Nigeria | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Pakistan | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Pakistan | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Pakistan | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Papua New Guinea | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Papua New Guinea | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Papua New Guinea | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Philippines | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Philippines | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Philippines | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Rwanda | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Rwanda | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Rwanda | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Samoa | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Samoa | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Samoa | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Senegal | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Senegal | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Senegal | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Sierra Leone | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Sierra Leone | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Sierra Leone | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Singapore | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Singapore | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Singapore | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Solomon Islands | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Solomon Islands | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Solomon Islands | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Somalia | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Somalia | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Somalia | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of South Africa | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of South Africa | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of South Africa | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Sri Lanka | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Sri Lanka | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Sri Lanka | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Thailand | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Thailand | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Thailand | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Togo | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Togo | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Togo | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Tokelau | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Tokelau | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Tokelau | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Tunisia | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Tunisia | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Tunisia | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Uganda | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Uganda | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Uganda | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Ukraine | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Ukraine | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Ukraine | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Vanuatu | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Vanuatu | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Vanuatu | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Viet Nam | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Viet Nam | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Viet Nam | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Zambia | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Zambia | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of Zambia | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Democratic Republic of the Congo | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Democratic Republic of the Congo | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Democratic Republic of the Congo | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Republic of the Congo | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Republic of the Congo | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Republic of the Congo | Tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Seychelles | Non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Seychelles | Tax and non-tax revenue |

| OECD Taxation Details of tax and non-tax revenue of the Seychelles | Tax revenue |

| OECD Taxation Details of tax revenue of Antigua and Barbuda | Tax revenue |

| OECD Taxation Details of tax revenue of Argentina | Tax revenue |

| OECD Taxation Details of tax revenue of Armenia | Tax revenue |

| OECD Taxation Details of tax revenue of Australia | Tax revenue |

| OECD Taxation Details of tax revenue of Australia in Revenue Statistics of Asia and the Pacific | Tax revenue |

| OECD Taxation Details of tax revenue of Austria | Tax revenue |

| OECD Taxation Details of tax revenue of Azerbaijan | Tax and non-tax revenue |

| OECD Taxation Details of tax revenue of Azerbaijan | Tax revenue |

| OECD Taxation Details of tax revenue of Bahamas | Tax revenue |

| OECD Taxation Details of tax revenue of Bangladesh | Tax revenue |

| OECD Taxation Details of tax revenue of Barbados | Tax revenue |

| OECD Taxation Details of tax revenue of Belgium | Tax revenue |

| OECD Taxation Details of tax revenue of Belize | Tax revenue |

| OECD Taxation Details of tax revenue of Bolivia | Tax revenue |

| OECD Taxation Details of tax revenue of Brazil | Tax revenue |

| OECD Taxation Details of tax revenue of Bulgaria | Tax revenue |

| OECD Taxation Details of tax revenue of Canada | Tax revenue |

| OECD Taxation Details of tax revenue of Chile | Tax revenue |

| OECD Taxation Details of tax revenue of Chile in Revenue Statistics in Latin America and the Caribbean | Tax revenue |

| OECD Taxation Details of tax revenue of China | Tax revenue |

| OECD Taxation Details of tax revenue of Colombia | Tax revenue |

| OECD Taxation Details of tax revenue of Colombia in Revenue Statistics in Latin America and the Caribbean | Tax revenue |

| OECD Taxation Details of tax revenue of Costa Rica | Tax revenue |

| OECD Taxation Details of tax revenue of Costa Rica in Revenue Statistics in Latin America and the Caribbean | Tax revenue |

| OECD Taxation Details of tax revenue of Croatia | Tax revenue |

| OECD Taxation Details of tax revenue of Cuba | Tax revenue |

| OECD Taxation Details of tax revenue of Czechia | Tax revenue |

| OECD Taxation Details of tax revenue of Denmark | Tax revenue |

| OECD Taxation Details of tax revenue of Dominican Republic | Tax revenue |

| OECD Taxation Details of tax revenue of Ecuador | Tax revenue |

| OECD Taxation Details of tax revenue of El Salvador | Tax revenue |

| OECD Taxation Details of tax revenue of Estonia | Tax revenue |

| OECD Taxation Details of tax revenue of Finland | Tax revenue |

| OECD Taxation Details of tax revenue of France | Tax revenue |

| OECD Taxation Details of tax revenue of Georgia | Tax revenue |

| OECD Taxation Details of tax revenue of Germany | Tax revenue |

| OECD Taxation Details of tax revenue of Greece | Tax revenue |

| OECD Taxation Details of tax revenue of Guatemala | Tax revenue |

| OECD Taxation Details of tax revenue of Guyana | Tax revenue |

| OECD Taxation Details of tax revenue of Honduras | Tax revenue |

| OECD Taxation Details of tax revenue of Hungary | Tax revenue |

| OECD Taxation Details of tax revenue of Iceland | Tax revenue |

| OECD Taxation Details of tax revenue of Indonesia | Tax revenue |

| OECD Taxation Details of tax revenue of Ireland | Tax revenue |

| OECD Taxation Details of tax revenue of Israel | Tax revenue |

| OECD Taxation Details of tax revenue of Italy | Tax revenue |

| OECD Taxation Details of tax revenue of Jamaica | Tax revenue |

| OECD Taxation Details of tax revenue of Japan | Tax revenue |

| OECD Taxation Details of tax revenue of Japan in Revenue Statistics of Asia and the Pacific | Tax revenue |

| OECD Taxation Details of tax revenue of Kiribati | Tax revenue |

| OECD Taxation Details of tax revenue of Korea | Tax revenue |

| OECD Taxation Details of tax revenue of Korea in Revenue Statistics of Asia and the Pacific | Tax revenue |

| OECD Taxation Details of tax revenue of Latvia | Tax revenue |

| OECD Taxation Details of tax revenue of Liechtenstein | Tax revenue |

| OECD Taxation Details of tax revenue of Lithuania | Tax revenue |

| OECD Taxation Details of tax revenue of Luxembourg | Tax revenue |

| OECD Taxation Details of tax revenue of Malaysia | Tax revenue |

| OECD Taxation Details of tax revenue of Malta | Tax revenue |

| OECD Taxation Details of tax revenue of Mexico | Tax revenue |

| OECD Taxation Details of tax revenue of Mexico in Revenue Statistics in Latin America and the Caribbean | Tax revenue |

| OECD Taxation Details of tax revenue of New Zealand | Tax revenue |

| OECD Taxation Details of tax revenue of New Zealand in Revenue Statistics of Asia and the Pacific | Tax revenue |

| OECD Taxation Details of tax revenue of Nicaragua | Tax revenue |

| OECD Taxation Details of tax revenue of Norway | Tax revenue |

| OECD Taxation Details of tax revenue of Panama | Tax revenue |

| OECD Taxation Details of tax revenue of Paraguay | Tax revenue |

| OECD Taxation Details of tax revenue of Poland | Tax revenue |

| OECD Taxation Details of tax revenue of Portugal | Tax revenue |

| OECD Taxation Details of tax revenue of Romania | Tax revenue |

| OECD Taxation Details of tax revenue of Saint Lucia | Tax revenue |

| OECD Taxation Details of tax revenue of Slovenia | Tax revenue |

| OECD Taxation Details of tax revenue of Spain | Tax revenue |

| OECD Taxation Details of tax revenue of Sweden | Tax revenue |

| OECD Taxation Details of tax revenue of Switzerland | Tax revenue |

| OECD Taxation Details of tax revenue of Timor-Leste | Tax revenue |

| OECD Taxation Details of tax revenue of Trinidad and Tobago | Tax revenue |

| OECD Taxation Details of tax revenue of Türkiye | Tax revenue |

| OECD Taxation Details of tax revenue of Uruguay | Tax revenue |

| OECD Taxation Details of tax revenue of Venezuela | Tax revenue |

| OECD Taxation Details of tax revenue of the Netherlands | Tax revenue |

| OECD Taxation Details of tax revenue of the Slovak Republic | Tax revenue |

| OECD Taxation Details of tax revenue of the United Kingdom | Tax revenue |

| OECD Taxation Details of tax revenue of the United States | Tax revenue |

| OECD Taxation Effective tax rates – Corporate tax statistics | Capital allowances |

| OECD Taxation Effective tax rates – Corporate tax statistics | Cost of capital |

| OECD Taxation Effective tax rates – Corporate tax statistics | Effective average tax rate |

| OECD Taxation Effective tax rates – Corporate tax statistics | Effective marginal tax rate |

| OECD Taxation Effective tax rates for expenditure based tax incentives – Corporate tax statistics | Cost of capital |

| OECD Taxation Effective tax rates for expenditure based tax incentives – Corporate tax statistics | Effective average tax rate |

| OECD Taxation Effective tax rates for expenditure based tax incentives – Corporate tax statistics | Implicit subsidy (EATR_ENH) |

| OECD Taxation Effective tax rates for expenditure based tax incentives – Corporate tax statistics | Implicit subsidy (PBAR_ENH) |

| OECD Taxation Effective tax rates for income based tax incentives – Corporate tax statistics | Cost of capital |

| OECD Taxation Effective tax rates for income based tax incentives – Corporate tax statistics | Effective average tax rate |

| OECD Taxation Effective tax rates for income based tax incentives – Corporate tax statistics | Implicit subsidy (EATR_ENH) |

| OECD Taxation Effective tax rates for income based tax incentives – Corporate tax statistics | Implicit subsidy (PBAR_ENH) |

| OECD Taxation Intellectual properties regimes – Corporate tax statistics | Asset types that can qualify for the IP regime |

| OECD Taxation Intellectual properties regimes – Corporate tax statistics | Further information |

| OECD Taxation Intellectual properties regimes – Corporate tax statistics | Reduced tax rate that applies under the IP regime |

| OECD Taxation Intellectual properties regimes – Corporate tax statistics | Regime name |

| OECD Taxation Intellectual properties regimes – Corporate tax statistics | Status of the IP regime as determined by the OECD’s Forum on Harmful Tax Practices (FHTP). |

| OECD Taxation Intellectual properties regimes – Corporate tax statistics | Tax rate that would otherwise apply |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Can interest be recharacterised as a dividend? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Do any loss carry-back or carry-forward provisions apply? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Financial accounting measure applied to rule |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Financial ratio referenced |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Is a de minimis threshold present? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Is the rule applicable to related party debt? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Is the rule is applicable to net or gross interest expensing? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Is the rule is applicable to third party debt? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Is there a group ratio rule or similar type of rule in place? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Is there an interest limitation rule in place? |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Reduced tax rate that applies under the IP regime |

| OECD Taxation Interest limitation rules – Corporate tax statistics | Type of interest limitation rule |

| OECD Taxation Labour taxation – OECD comparative indicators | Average income tax rate |

| OECD Taxation Labour taxation – OECD comparative indicators | Average rate of employees’ social security contributions |

| OECD Taxation Labour taxation – OECD comparative indicators | Average rate of employer’s social security contributions |

| OECD Taxation Labour taxation – OECD comparative indicators | Average rate of income tax and employees’ social security contributions |

| OECD Taxation Labour taxation – OECD comparative indicators | Average tax wedge |

| OECD Taxation Labour taxation – OECD comparative indicators | Gross earnings before taxes |

| OECD Taxation Labour taxation – OECD comparative indicators | Gross labour costs before taxes |

| OECD Taxation Labour taxation – OECD comparative indicators | Increase in net income after an increase of 1 currency unit in gross labour costs |

| OECD Taxation Labour taxation – OECD comparative indicators | Increase in net income after an increase of 1 currency unit in gross wages |

| OECD Taxation Labour taxation – OECD comparative indicators | Marginal tax wedge of the principal earner |

| OECD Taxation Labour taxation – OECD comparative indicators | Net income after taxes |

| OECD Taxation Labour taxation – OECD comparative indicators | Net personal average tax rate |

| OECD Taxation Labour taxation – OECD comparative indicators | Net personal marginal tax rate of the principal earner |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Average central income tax |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Average local income tax |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Average tax wedge |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Cash benefits |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Employee social security contributions |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Employer social security contributions |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Employer social security contributions and payroll taxes |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Gross wage earnings |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Income tax of central government |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Income tax of local government |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Labour costs |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Marginal cash benefits |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Marginal central income tax |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Marginal employee social security contributions |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Marginal employer social security contributions and payroll taxes |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Marginal local income tax |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Marginal tax wedge |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Net personal average tax rate |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Net personal marginal tax rate |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Net wage earnings |

| OECD Taxation Labour taxation – average and marginal tax wedge decompositions | Payroll taxes |

| OECD Taxation Labour taxation – detailed OECD member country tables | Average income tax rate |

| OECD Taxation Labour taxation – detailed OECD member country tables | Average rate of employees’ social security contributions |

| OECD Taxation Labour taxation – detailed OECD member country tables | Average rate of employer’s social security contributions |

| OECD Taxation Labour taxation – detailed OECD member country tables | Average tax wedge |

| OECD Taxation Labour taxation – detailed OECD member country tables | Basic tax allowance |

| OECD Taxation Labour taxation – detailed OECD member country tables | Basic tax credit |

| OECD Taxation Labour taxation – detailed OECD member country tables | Cash transfers |

| OECD Taxation Labour taxation – detailed OECD member country tables | Cash transfers CRDS deducted |

| OECD Taxation Labour taxation – detailed OECD member country tables | Cash transfers for Green Check |

| OECD Taxation Labour taxation – detailed OECD member country tables | Cash transfers for head of family |

| OECD Taxation Labour taxation – detailed OECD member country tables | Cash transfers for two children |

| OECD Taxation Labour taxation – detailed OECD member country tables | Cash transfers from general government |

| OECD Taxation Labour taxation – detailed OECD member country tables | Central government income tax finally paid |

| OECD Taxation Labour taxation – detailed OECD member country tables | Central government income tax liability (exclusive of tax credits) |

| OECD Taxation Labour taxation – detailed OECD member country tables | Central government taxable income |

| OECD Taxation Labour taxation – detailed OECD member country tables | Child tax credit |

| OECD Taxation Labour taxation – detailed OECD member country tables | Deduction for social security contributions and income taxes |

| OECD Taxation Labour taxation – detailed OECD member country tables | Dependent children tax allowances |

| OECD Taxation Labour taxation – detailed OECD member country tables | Dependent family member tax allowances |

| OECD Taxation Labour taxation – detailed OECD member country tables | Earnings tax credit deduction |

| OECD Taxation Labour taxation – detailed OECD member country tables | Employee social security contributions |

| OECD Taxation Labour taxation – detailed OECD member country tables | Employees’ compulsory social security contributions |

| OECD Taxation Labour taxation – detailed OECD member country tables | Employees’ compulsory social security contributions payable on gross earnings |

| OECD Taxation Labour taxation – detailed OECD member country tables | Employees’ compulsory social security contributions payable on taxable income |

| OECD Taxation Labour taxation – detailed OECD member country tables | Employer social security contributions |

| OECD Taxation Labour taxation – detailed OECD member country tables | Employers’ compulsory social security contributions |

| OECD Taxation Labour taxation – detailed OECD member country tables | Employers’ compulsory social security contributions and payroll taxes |

| OECD Taxation Labour taxation – detailed OECD member country tables | Flood levy |

| OECD Taxation Labour taxation – detailed OECD member country tables | Gross earnings before taxes |

| OECD Taxation Labour taxation – detailed OECD member country tables | Income tax |

| OECD Taxation Labour taxation – detailed OECD member country tables | Labour costs |

| OECD Taxation Labour taxation – detailed OECD member country tables | Marginal tax wedge of the principal earner |

| OECD Taxation Labour taxation – detailed OECD member country tables | Marginal tax wedge of the secondary earner |

| OECD Taxation Labour taxation – detailed OECD member country tables | Married or head of family tax allowances |

| OECD Taxation Labour taxation – detailed OECD member country tables | Married or head of family tax credit |

| OECD Taxation Labour taxation – detailed OECD member country tables | Medicare levy |

| OECD Taxation Labour taxation – detailed OECD member country tables | Net personal average tax rate |

| OECD Taxation Labour taxation – detailed OECD member country tables | Net personal marginal tax rate of the principal earner |

| OECD Taxation Labour taxation – detailed OECD member country tables | Net personal marginal tax rate of the secondary earner |

| OECD Taxation Labour taxation – detailed OECD member country tables | Other standard tax allowances |

| OECD Taxation Labour taxation – detailed OECD member country tables | Other tax credits |

| OECD Taxation Labour taxation – detailed OECD member country tables | Payroll taxes |

| OECD Taxation Labour taxation – detailed OECD member country tables | Stamp tax |

| OECD Taxation Labour taxation – detailed OECD member country tables | Standard tax allowances |

| OECD Taxation Labour taxation – detailed OECD member country tables | State and local taxes |

| OECD Taxation Labour taxation – detailed OECD member country tables | Surtax |

| OECD Taxation Labour taxation – detailed OECD member country tables | Take-home pay |

| OECD Taxation Labour taxation – detailed OECD member country tables | Tax credits |

| OECD Taxation Labour taxation – detailed OECD member country tables | Tax credits or cash transfers included in taxable income |

| OECD Taxation Labour taxation – detailed OECD member country tables | Temporary Budget Repair Levy |

| OECD Taxation Labour taxation – detailed OECD member country tables | Total payments to general government |

| OECD Taxation Labour taxation – detailed OECD member country tables | Unused wastable tax credits |

| OECD Taxation Labour taxation – detailed OECD member country tables | Work-related expenses tax allowance |

| OECD Taxation Net effective carbon rates | Carbon tax |

| OECD Taxation Net effective carbon rates | Effective carbon rate |

| OECD Taxation Net effective carbon rates | Emissions trading system (ETS) permit price |

| OECD Taxation Net effective carbon rates | Fossil fuel subsidy |

| OECD Taxation Net effective carbon rates | Fuel excise tax |

| OECD Taxation Net effective carbon rates | Net effective carbon rate |

| OECD Taxation Net effective carbon rates | Potential tax base (emissions) |

| OECD Taxation Net effective carbon rates | Total tax |

| OECD Taxation Net effective energy rates | Carbon tax |

| OECD Taxation Net effective energy rates | Effective energy rate |

| OECD Taxation Net effective energy rates | Electricity excise tax |

| OECD Taxation Net effective energy rates | Electricity subsidy |

| OECD Taxation Net effective energy rates | Emissions trading system (ETS) permit price |

| OECD Taxation Net effective energy rates | Fossil fuel subsidy |

| OECD Taxation Net effective energy rates | Fuel excise tax |

| OECD Taxation Net effective energy rates | Net effective energy rate |

| OECD Taxation Net effective energy rates | Potential tax base (energy) |

| OECD Taxation Net effective energy rates | Total subsidy |

| OECD Taxation Net effective energy rates | Total tax |

| OECD Taxation Net energy tax revenues and reform potential | Additional revenue from carbon price floor of EUR 120 |

| OECD Taxation Net energy tax revenues and reform potential | Additional revenue from carbon price floor of EUR 60 |

| OECD Taxation Net energy tax revenues and reform potential | Additional revenue from phasing out free allocation |

| OECD Taxation Net energy tax revenues and reform potential | Carbon tax revenues |

| OECD Taxation Net energy tax revenues and reform potential | Current net carbon pricing revenues |

| OECD Taxation Net energy tax revenues and reform potential | Electricity excise revenues |

| OECD Taxation Net energy tax revenues and reform potential | Electricity subsidies |

| OECD Taxation Net energy tax revenues and reform potential | Emission trading systems (ETS) revenues adjusted for free allocation |

| OECD Taxation Net energy tax revenues and reform potential | Fossil fuel subsidies |

| OECD Taxation Net energy tax revenues and reform potential | Fuel excise revenues |

| OECD Taxation Net energy tax revenues and reform potential | Net energy tax revenues |

| OECD Taxation Net energy tax revenues and reform potential | Potential revenue from fossil fuel subsidies reform |

| OECD Taxation Net energy tax revenues and reform potential | Total reform potential |

| OECD Taxation Personal income tax – central government rates and thresholds for a single person at 100% of average wage without dependents | Personal income tax |

| OECD Taxation Personal income tax – sub-central rates and thresholds for a progressive system for a single person at 100% of average wage without dependants | Personal income tax,progressive system |

| OECD Taxation Personal income tax – sub-central rates for a non-progressive system for a single person at 100% of average wage without dependants | Personal income tax |

| OECD Taxation Personal income tax – top statutory rate and marginal tax rate for employees at the earnings threshold where the top statutory personal income tax rate first applies | Average wage |

| OECD Taxation Personal income tax – top statutory rate and marginal tax rate for employees at the earnings threshold where the top statutory personal income tax rate first applies | Personal marginal income tax and employee social security contribution rate at top statutory tax rate earnings threshold |

| OECD Taxation Personal income tax – top statutory rate and marginal tax rate for employees at the earnings threshold where the top statutory personal income tax rate first applies | Personal marginal income tax rate at top tax rate earnings threshold |

| OECD Taxation Personal income tax – top statutory rate and marginal tax rate for employees at the earnings threshold where the top statutory personal income tax rate first applies | Top statutory personal income tax rate |

| OECD Taxation Personal income tax – top statutory rate and marginal tax rate for employees at the earnings threshold where the top statutory personal income tax rate first applies | Top statutory personal income tax rate earnings threshold |

| OECD Taxation Personal income tax and social security contributions – average combined personal income tax and employee social security contribution rates by household type | Personal income tax and employee social security contributions |

| OECD Taxation Personal income tax and social security contributions – average combined personal income tax and employee social security contribution rates by household type | Personal income tax and employee social security contributions less cash transfers |

| OECD Taxation Personal income tax and social security contributions – average rates on gross wage earnings for a single person without dependent | Employee social security contributions |

| OECD Taxation Personal income tax and social security contributions – average rates on gross wage earnings for a single person without dependent | Employer social security contributions |

| OECD Taxation Personal income tax and social security contributions – average rates on gross wage earnings for a single person without dependent | Personal income tax |

| OECD Taxation Personal income tax and social security contributions – average rates on gross wage earnings for a single person without dependent | Personal income tax and employee social security contributions |

| OECD Taxation Personal income tax and social security contributions – average rates on gross wage earnings for a single person without dependent | Tax wedge |

| OECD Taxation Personal income tax and social security contributions – marginal rates on gross wage earnings for a single person without dependents | Employee social security contributions |

| OECD Taxation Personal income tax and social security contributions – marginal rates on gross wage earnings for a single person without dependents | Employer social security contributions |

| OECD Taxation Personal income tax and social security contributions – marginal rates on gross wage earnings for a single person without dependents | Personal income tax |

| OECD Taxation Personal income tax and social security contributions – marginal rates on gross wage earnings for a single person without dependents | Personal income tax and employee social security contributions |

| OECD Taxation Personal income tax and social security contributions – marginal rates on gross wage earnings for a single person without dependents | Tax wedge |

| OECD Taxation Reference series of African countries | Gross domestic product, current prices |

| OECD Taxation Reference series of African countries | Nominal exchange rates |

| OECD Taxation Reference series of Asia and the Pacific economies | Gross domestic product, current prices |

| OECD Taxation Reference series of Asia and the Pacific economies | Nominal exchange rates |

| OECD Taxation Reference series of Latin American and Caribbean countries | Gross domestic product, current prices |

| OECD Taxation Reference series of Latin American and Caribbean countries | Nominal exchange rates |

| OECD Taxation Reference series of OECD member countries | Gross domestic product, current prices |

| OECD Taxation Reference series of OECD member countries | Nominal exchange rates |

| OECD Taxation Reference series of countries in the global database | Gross domestic product, current prices |

| OECD Taxation Reference series of countries in the global database | Nominal exchange rates |

| OECD Taxation Revenue forgone and net effective carbon rates | Revenue forgone |

| OECD Taxation Shares of CO2 emissions from energy priced | Share of emissions priced |

| OECD Taxation Shares of emissions priced | Carbon tax |

| OECD Taxation Shares of emissions priced | Effective carbon rate |

| OECD Taxation Shares of emissions priced | Emissions trading system (ETS) permit price |

| OECD Taxation Shares of emissions priced | Explicit carbon price |

| OECD Taxation Shares of emissions priced | Fossil fuel subsidy |

| OECD Taxation Shares of emissions priced | Fuel excise tax |

| OECD Taxation Shares of emissions priced | Net effective carbon rate |

| OECD Taxation Shares of emissions priced | Total tax |

| OECD Taxation Social security contributions and payroll taxes paid by government in OECD member countries | Tax revenue |

| OECD Taxation Standard withholding tax rates – Corporate tax statistics | Dividends |

| OECD Taxation Standard withholding tax rates – Corporate tax statistics | Interest |

| OECD Taxation Standard withholding tax rates – Corporate tax statistics | Royalties |

| OECD Taxation Standard withholding tax rates – Corporate tax statistics | Technical fees |

| OECD Taxation Treaty based withholding tax rates – Corporate tax statistics | Dividends |

| OECD Taxation Treaty based withholding tax rates – Corporate tax statistics | Interest |

| OECD Taxation Treaty based withholding tax rates – Corporate tax statistics | Royalties |

| OECD Taxation Treaty based withholding tax rates – Corporate tax statistics | Technical fees |

コメント